Breaking down the InfraRed report

What we discussed at the InfraRed Summit

Last week, we hosted our inaugural InfraRed Summit in NYC where we showcased the exciting innovation taking place within infrastructure software across both the public and private markets. During the summit, we presented our InfraRed report to all the attendees. In this post, we’ll go through the details of that report.

Framing the Market

The world runs on infrastructure software, enabling how we work, communicate, travel, and countless other activities. Infrastructure software is the invisible yet critical layer that supports the dozens of apps we interact with. It powers businesses across all verticals — it truly is the engine behind global software delivery and consumption.

It’s important to call out that infrastructure software isn’t new. It’s existed for decades. But, what has changed is how we write software. Infrastructure software has evolved through massive architectural shifts to make it drastically easier to create applications. And this evolution has profound implications in the birth of new technologies, but also value creation in the public and private markets.

25 years ago, teams had to calculate the physical space required for the numerous server racks they needed to purchase. The primary architecture was the monolith system. This framework was highly centralized with the database, client-side and server-side logic wrapped into one unit, which led to scalability and reliability issues. Changes made to the app affected the entire system which led to slower deployments and downtime. There were huge barriers to entry for app development. Technological breakthroughs like the introduction of client / server and virtualization were the first steps in progressing app development.

2006 was a pivotal year with Amazon’s release of EC2 and S3, which laid the foundation for the widespread adoption of cloud computing. It turned fixed costs into OpEx and greatly lowered barriers to entry as teams didn’t need to purchase hardware. But, it was still incredibly cumbersome and expensive to build in the cloud. Teams took package software and ran it in the cloud (i.e. “lift and shift”), and this came with a host of problems related to software compatibility, data loss, and downtime. Entire systems had to be rebuilt. Ultimately, teams never unlocked the full potential of the cloud.

But over the last 10 years, key technologies were built for the cloud. Take Snowflake for example - it markets itself as a cloud data warehouse. These technologies were built with the cloud in mind and made it dramatically easier to create and manage apps. In turn, customers reaped the benefits of the cloud, like multitenancy, on-demand self-service, and infinite scalability. Importantly, the process of building technologies for the cloud created exceptional businesses like Snowflake and Datadog in the process.

We categorize infrastructure software into three main buckets: DevOps & developer tools, cybersecurity, and data & AI. Here are some high-level takeaways we’re seeing within each:

DevOps & developer tools:

It’s becoming easier to build resilient, distributed apps for the cloud with technologies like Temporal. Simultaneously, higher level abstractions and simpler primitives like Fly.io and Railway are emerging to deliver a better developer and end-user experience, which levels the playing field for front end developers.

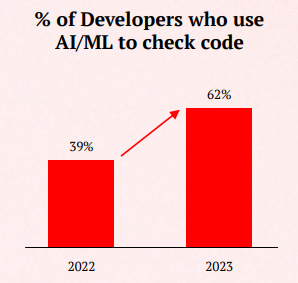

An important driver is the convergence of ML in the software delivery lifecycle. Solutions like GitHub Copilot are revolutionary, and lower the barriers to app development at a magnitude we have never seen before.

Cybersecurity

Cloud is upending the security stack. A wave of startups like Orca Security, Upwind, and Wiz have emerged to address various pain-points of security in the cloud.

Remote work has fundamentally changed how we think about our network boundaries and securing user accounts. Understanding the identity of users and devices and related access is critical for the next generation of security.

30% of all AI cyberattacks will leverage training data poisoning to attack AI-powered systems. The risks and need for tooling around data security for AI models have made DSPM and DLP vendors top-of-mind.

Data & AI

Within data, we have seen a true open ecosystem emerge around cloud data, with a level of interoperability that didn't exist in past decades.

A new stack has recently emerged that avoids vendor lock-in and rising costs with data warehouses. This architecture consists of open-source data formats like Apache Iceberg and specialized query engines like Motherduck on top of S3.

Within AI, we have seen the quick rise of foundation models. These models are akin to AWS servers to build and scale intelligent applications, and a wave of ML infrastructure tooling has emerged to push us into the age of AI. We’re seeing unprecedented interesting among developers within AI, and almost every part of the economy is benefiting from AI use cases today.

Cloud Infrastructure by the Numbers

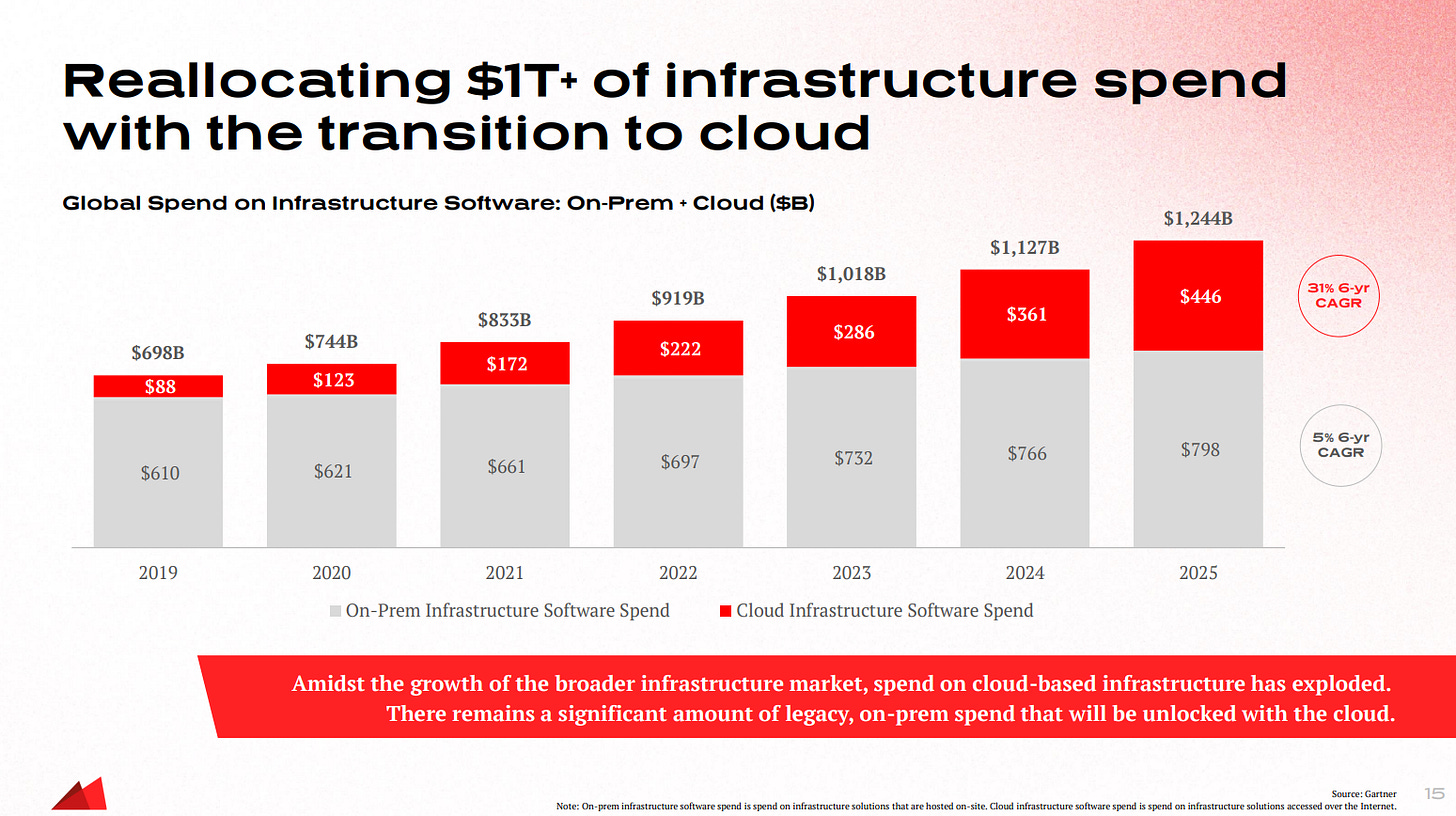

Next year, B2B cloud spend is projected to hit nearly $600B. When we split this total into spend on application software and infrastructure software vendors, it’s interesting to see that infrastructure software comprises 60% of total B2B cloud spend. Infrastructure software is the larger and faster growing segment across all years and the gap is widening. Infrastructure spend is moving from on-prem to the cloud at an accelerated rate, and this is creative a massive market opportunity.

Let’s examine infrastructure spend specifically. The chart below shows total infrastructure software spend split between on-prem and cloud. This year, the total infrastructure market will surpass $1T (!) in spend, and what’s driving that is the growth in cloud, growing at a ~30% CAGR through 2025. Spend within the cyber, data, and DevOps markets has skyrocketed over the last decade. These individual categories are huge, which indicates that each has the potential to support multiple, standalone businesses

It’s important to call out that this isn’t a zero-sum game between on-prem and cloud. As the broader infrastructure software market grows, on-prem spend will be considerably higher than cloud spend over the coming years. But, the gap is narrowing, and there remains a significant amount of legacy, on-prem spend that will be unlocked as infrastructure workloads move to the cloud.

This bring us to our first point: cloud infrastructure companies are operating in massive and accelerating markets. The analysis below looks at TAMs of various infrastructure businesses at the time of their IPOs and what analysts estimate their TAMs to be in 2025. Consider Snowflake which went public in 2020 with a TAM estimate of $80B. In 2025, their TAM is expected to be $230B, implying an annual expansion of $30B. Similarly, Cloudflare, Crowdstrike, and Datadog’s markets are growing at aggressive clips. This means that these businesses have plenty of market to sell into for the coming years.

But, there’s more to it than just big markets. There are unique attributes of these businesses to better maximize the size of their TAMs, and the first we highlighted is the inherent business model of infrastructure software. Infrastructure businesses typically employ usage-based pricing while application SaaS vendors often charge on the number of seats. This is an important distinction. The beauty of usage-based pricing is that pricing is directly tied to the value delivered to your customers. So, if a piece of technology is as fundamental as infrastructure software, then you can expect increasing consumption and a higher net dollar retention - or the ability to upsell your existing customers. And that’s what we see when we divide the public SaaS universe into application software and infrastructure software: infrastructure software as a whole has a higher NDR of 120% versus 113% for application software.

Another unique characteristic is how common it is for infrastructure businesses to be multi-product. Going back to the benefits of the cloud delivery model, enabling new features and products is as straightforward as activating software and no longer a massive undertaking. This allows businesses to build and sell multiple product lines with greater ease.

Let’s take Datadog for example. Datadog initially started off as an infrastructure monitoring company. Over the years, they’ve added product lines around APM, logging, security, and developer experience. And it’s not just Datadog — of the public SaaS universe, over 80% of infrastructure businesses sell at least 2 different products, allowing them to better maximize their TAMs. This allows these businesses to generate incremental revenue faster and easier.

The final observation we highlighted is that infrastructure software is more profitable relative to application software. Below is a cohort analysis measuring infrastructure and application software businesses at the time of their IPOs and tracking their FCF margin over the following 5 years. We see that infrastructure software businesses (1) reach profitability faster and (2) continue to become more profitable for key reasons:

On average, ACVs for infrastructure products are higher relative to ACVs for application software. This is driven by the multi-product nature of infrastructure businesses

Some infrastructure software businesses are open-source and can harvest their bottoms-up customer base with minimal to no CAC, leading to efficiency gains

So, these four dynamics: (1) massive TAMs at the individual company level, (2) the power of usage-based pricing, (3) the prevalence of multi-product, and (4) increased profitability create outstanding results in the public markets. The chart below shows the top 10 fastest growing public software businesses with at least $500M in ARR. 70% of the top 10 are infrastructure businesses, with companies like SentinelOne, Snowflake, GitLab, and Confluent. What’s amazing is that these businesses continue to grow quickly at massive scale. Crowdstrike and Snowflake are $2.5B top-line businesses growing ~50% YoY. These revenue figures are enormous and resemble TAM estimates instead.

Let’s examine Datadog, which is the perfect case study on building a platform business within infrastructure software. When Datadog went public in 2019, half of its customer base was using at least two different products. Since then, that figure has grown to over 80% and their customer count has nearly tripled, driving billions in shareholder value. Datadog’s ARR is nearly $2B today and it’s highly profitable; each year, it throws off 20% in FCF. Even taking into account this market pullback, Datadog’s market cap has still over tripled.

Another interesting phenomenon that we’re observing is that infrastructure businesses are accelerating out of the gate and hitting the $100M ARR mark faster and faster. The analysis below shows the time needed to hit $100M in ARR and notes the founding date for each company above. MongoDB was founded in 2007 and it took them roughly 7 years to hit that number. HashiCorp and Snowflake, founded in 2012, did it in a little over 3 years. Most recently, Wiz Security, founded just 3 years ago, hit that mark in a record-breaking 18 months. This shows that the shift of infrastructure workloads moving from on prem to the cloud is only accelerating and it’s captured in these businesses.

Let’s look at how these two categories stack up against each other. The figures below show the median for each metric across infrastructure software and application software businesses in the public markets. A couple of observations:

Infrastructure businesses are 2-3x larger than application software ones by market cap

Infrastructure businesses as a whole grow quicker and a lot of that is driven by their higher NDR - 120% vs 113%

Profitability metrics like FCF and rule of 40 are considerably higher - almost double for FCF margin

These metrics are drivers for long-term returns. The multiple return since IPO is a metric that looks at the share price of a company today relative to what it was when it went public. We can see that, over the long-run, infrastructure businesses return ~3x in the public markets while app software companies return half of that at ~1.5x.

That said, the market is missing a pure-play index that focuses on this basket of cloud-native infrastructure. The rest of tech-focused indexes have a mix of companies selling application software, infrastructure software, hardware and businesses that mostly sell on-prem. We’re missing an index that focus on pure, cloud-native infrastructure, which is why we’re excited to introduce The Nasdaq Redpoint Cloud Infrastructure Software Index ($NQRPCI).

Redpoint launched this index in partnership with Nasdaq, and it contains 25 businesses across the three main categories of infrastructure software. It’s interesting to note that the median IPO date of this index is 2019, so most of these companies have gone public in the last 4 years. In aggregate, the index represents over $450B in market cap today.

We launched this index with Nasdaq back in April, and it’s off to a strong start. In the last three months, the index is up 27%, outperforming the Nasdaq by 2x and the S&P over 4x in just three months.

What’s exciting is that there is a huge backlog of private infrastructure software companies waiting to go public, including the likes of Databricks, Snyk, Stripe, and Wiz. We expect to add these companies to NQRPCI as the market rebounds.

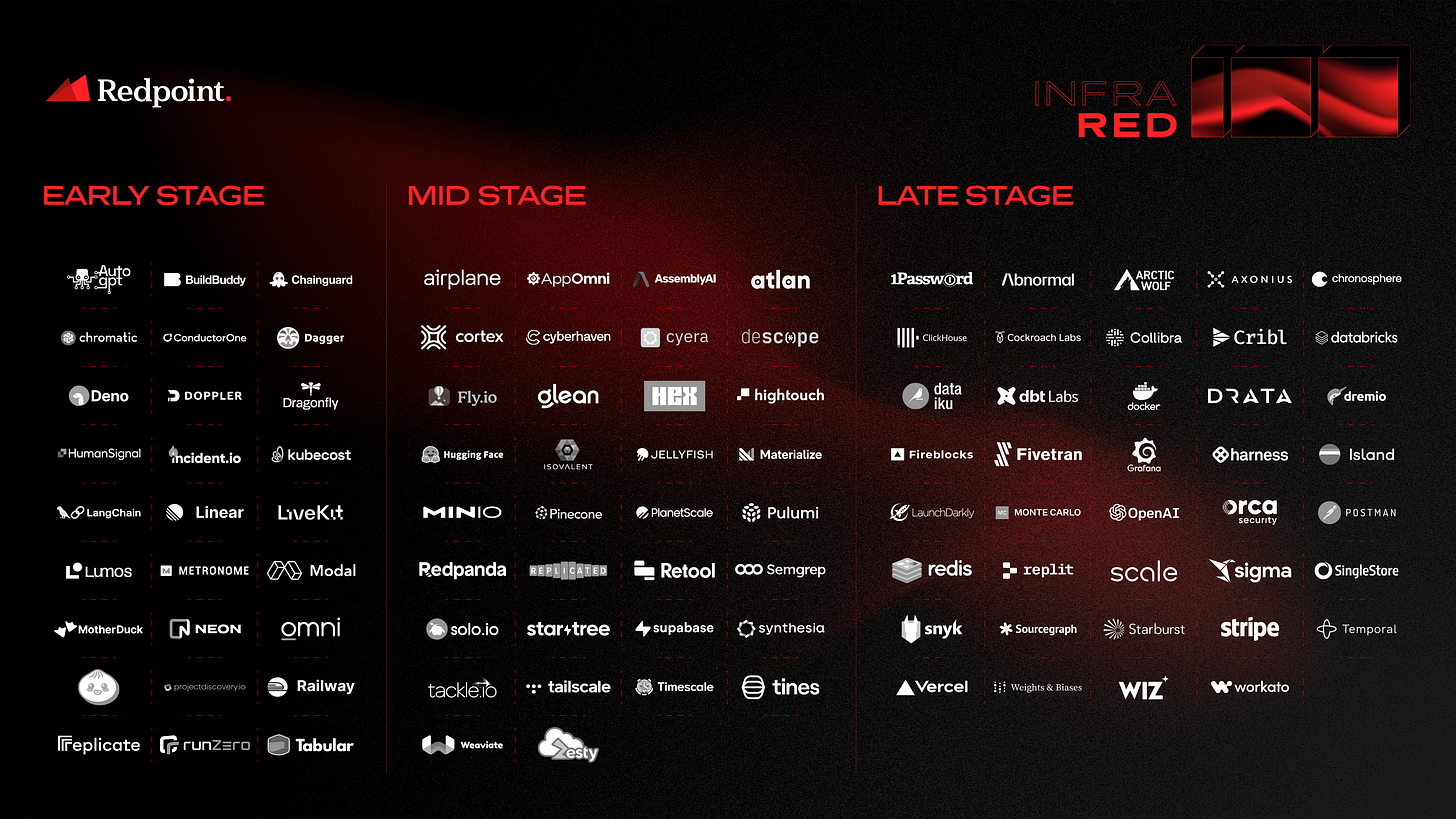

We concluded the summit with the unveiling of the InfraRed 100, a list of 100 of the fastest-growing private businesses within cloud infrastructure. We expect some of these names to join NQPRCI in the coming years - this is just the beginning!

Love this!! Would love your thoughts on some of my stuff. Follow me back I could DM you?

Thank you Thank you Thank you. Sharing your expert experience was exciting. You provided with clear detail the strengths and shortfalls in the cloud community. You have inspired my learning journey. Thank you again