As software transforms how businesses operate, companies across all industries are re-platforming to cloud infrastructure to enable software delivery and consumption. Cloud infrastructure is the most important enabler of digital transformation efforts worldwide - behemoths like AWS and Azure have allowed countless startups to scale without having to worry about underlying infrastructure, letting them focus on product instead. What’s underpinning these digital transformation efforts is a seismic shift from static on-premise IT primitives to distributed multi-cloud architectures.

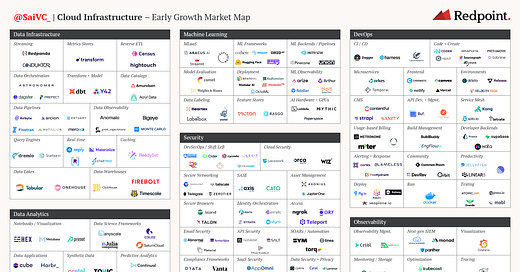

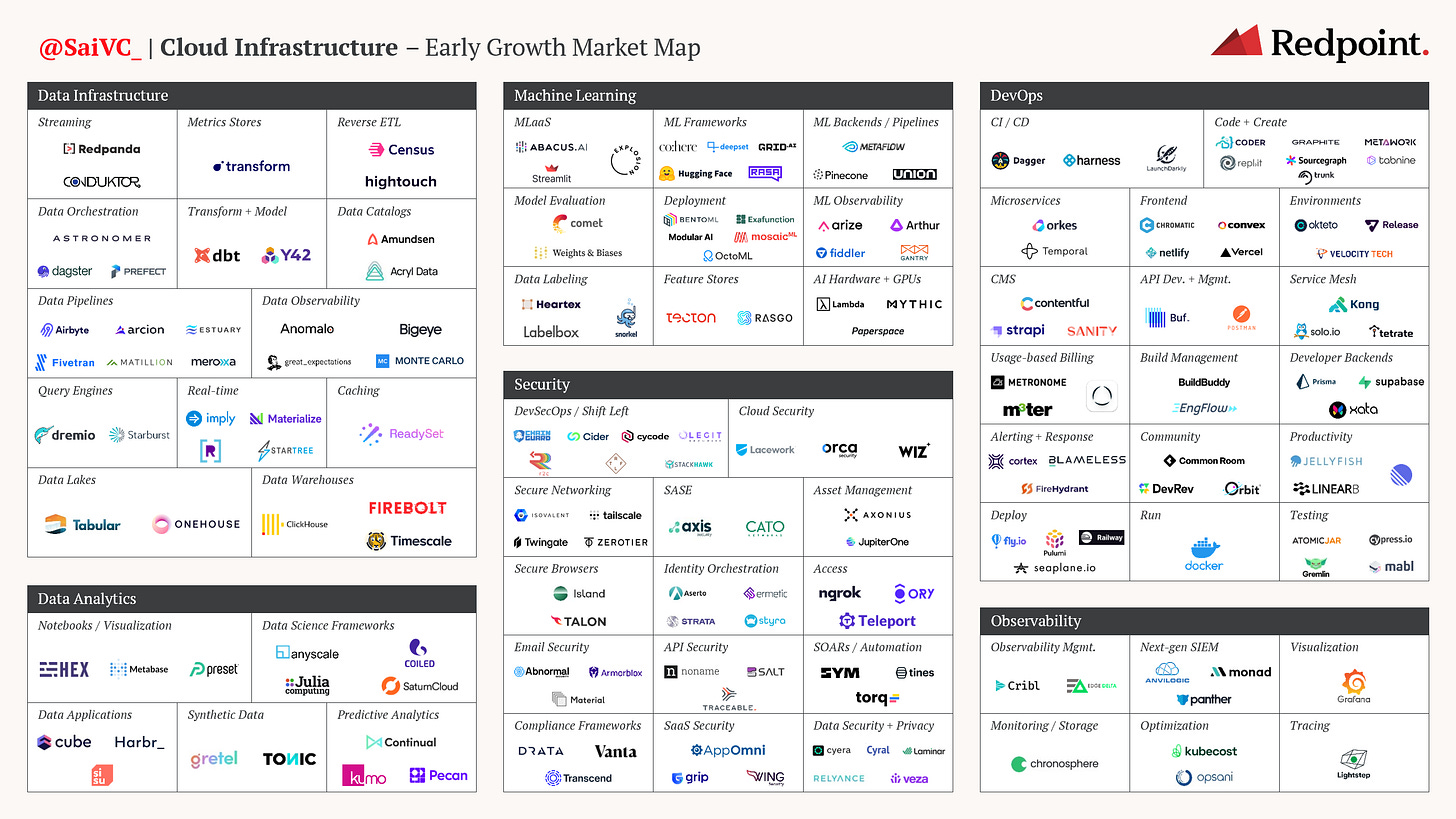

Gartner estimates ~$850B in cloud infrastructure spend in 20251. What are the next set of infrastructure providers that will drive this spend? Which infra companies are hitting product-market-fit (PMF) today and tackling real problems? In this post, we’ll introduce Redpoint’s view on the exciting innovation happening within infrastructure software and provide a market map of companies to closely track.

Cloud infrastructure rules public SaaS

Cloud infrastructure markets are enormous — AWS, Azure, and GCP continue to grow at mindboggling scale, eclipsing $100B in revenue run-rate last year. As companies migrate to the cloud and their underlying infrastructure changes, a whole new toolchain has emerged. Businesses like Confluent, Datadog, HashiCorp, Okta, Snowflake, Twilio, etc. power virtually every industry and have created extremely successful businesses in the software markets.

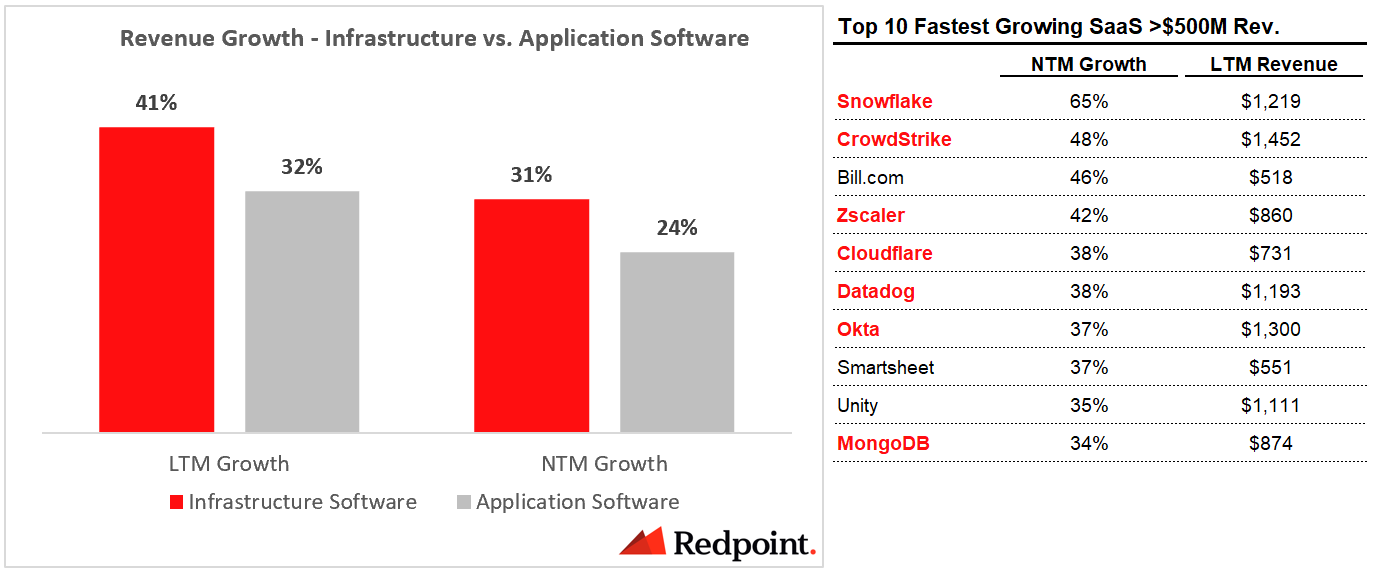

These infrastructure providers, on average, are growing quicker than their SaaS counterparts in the public markets. 7 out of the top 102 fastest growing cloud businesses with over $500M in revenue are infrastructure-related ones.

Not only are these infrastructure providers growing quickly, but they are growing quickly at scale. At ~$1.5B in ARR, Snowflake is still doubling year-over-year. Similarly, Crowdstrike at ~$1.7B ARR is growing 65% YoY while Datadog at ~$1.3B ARR is growing 70% YoY. These kinds of figures were unfathomable a few years back.

Apart from faster growth, infrastructure software seems to have better fundamentals. For example, net dollar retention, or how much a company’s existing customers expand or contract YoY, is ~20 bps higher for an infrastructure software provider. The appeal of these types of businesses is that their business model is intrinsically connected to the success of their customers, and often charge based on consumption / usage. Pricing is based on value delivered directly to end-users rather than the traditional model of selling on a per-seat basis like in application software. As a result, if a service is as critical as Snowflake or Datadog and is pegged to a fundamental trend (i.e. transition to cloud), then expect accelerating consumption and soaring ACVs. Higher NDR of course correlates strongly with faster topline growth.

It’s also interesting to see infrastructure SaaS win in the efficiency category when comparing SaaS metrics like Rule of 403 and payback4.

The effect on private market valuations

We see the effects of faster growth and attractive outcomes for public infrastructure companies trickle down into the private markets. It’s remarkable to see how much higher the typical Series B and Series C infrastructure startup is valued in recent years. The median Series C for an infrastructure startup went for ~$200M post in 20175. Last year, infrastructure software founders were fetching ~$1B post-money for their companies, a ~5x expansion! Investors are underwriting to larger outcomes and providing companies with several years worth of capital at extremely attractive terms.

It will be interesting to track where 2022 infrastructure valuations within the private markets shake out and see if there is as much of a pullback as we have seen in the public markets. Anecdotally, although tier I infra assets within the private markets are still going for 2021 prices, it seems that as a whole valuations across the Series B and Series C have noticeably declined in the past few months.

What’s next for cloud infrastructure?

We’re excited to share our Early Growth overview of Cloud Infrastructure6, with the hopes of highlighting the:

Amazing entrepreneurs and teams building the next wave of enduring infrastructure enterprises

Key themes driving innovation within cloud infrastructure

Budget dynamics for each vertical, showing how practitioners are allocating their budget for solutions today but also the future (subsequent posts)

We take a broad definition of Cloud Infrastructure to assume software enabling Data Infrastructure & Data Analytics, DevOps, Machine Learning, Observability, and Security.

This market map and analysis is certainly not exhaustive, but gives a view into the amazing innovation that is happening right before our eyes. We’re sure a lot of these names will become household ones soon (and some already have). And what’s even more exciting is that we are in the early innings of cloud adoption — the big three cloud vendors will represent less than 15% of overall enterprise IT spend this year7. There is significant room for growth as more enterprises embrace cloud technologies, and we will see countless exciting cloud infrastructure startups in the coming years.

In the following weeks, we will dive into each of the above subcategories and highlight key trends which should help enterprises leaders as they try out and adopt these new solutions. We surveyed over 200+ operators in our network, and have interesting data around budget spend, relative prioritization of vendors, etc. which we will share in the coming weeks. Stay tuned!

Source: Gartner (2021)

Source: Pitchbook, company filings. Market data as of 5/6/2022. Infrastructure software basket includes Alteryx, Atlassian, C3.ai, Cloudflare, Confluent, CrowdStrike, Datadog, Digital Ocean, Dynatrace, Elastic, Fastly, GitLab, HashiCorp, JFrog, MongoDB, New Relic, Okta, PagerDuty, Ping Identity, SentinelOne, Snowflake, Splunk, Sumo Logic, Tenable, Twilio, UiPath, and Zscaler.

Rule of 40 defined as LTM revenue growth + LTM EBITDA margin.

Payback is gross-margin burdened. Defined as (Previous Q S&M) / (Net New ARR x Gross Margin) x 12.

Source: Pitchbook.

Methodology → We define ‘Early Growth’ as venture-backed startups between Series A and Series C in their lifecycle that were founded after 2010. There are some seed and Series D companies in the market map for completeness. These companies have raised new capital within the last 18 months and have PMF. They are focused on expansion and go-to-market (GTM) efforts as they sell their innovative technologies.

Source: Gartner (2021).

Wonderful post and great analysis/research. I feel there's a large piece of this puzzle missing - Low code - especially in the DevOps space. Tools like Budibase[1] and [2] Retool are integrating with the IT stack and offer a great solution for building internal apps in the data infra stack.

[1] https://github.com/Budibase/budibase / https://budibase.com

[2] https://retool.com/

Very interesting series, Sai! Have you looked into the SaaS Management space. Where do SaaS management platforms fit in? Would love to hear your thoughts.